The Technology Layer That Turns Any Platform Into a Lender

The Embedded Credit Infrastructure for India

Complete credit infrastructure to embed financing in your ecosystem or power co-lending partnerships.

APIs, underwriting, compliance, and capital connections — all in one platform.

Powering Credit for Leading Digital Ecosystems

$150M+ Credit Processed

300+ Platforms Connected

10,000+ MSMEs Funded

15+ Industries

The Real Problem

The Credit Gap Is Costing You Growth

For Platforms & Ecosystems

- You have customers who need working capital, but no way to offer it.

- Sending leads to external lenders means losing control and revenue.

- Building in-house lending infrastructure takes years and millions in investment.

- Your merchants churn because they can't access timely credit within your ecosystem.

For MSME Lenders

- Sourcing quality MSME borrowers is expensive and time-intensive.

- You lack access to real-time transactional data for better underwriting.

- Traditional branch-based lending models can't scale to digital-first businesses.

- Co-lending partnerships are complex to structure, execute, and manage.

You need infrastructure that handles the complexity—so you can focus on your customers.

Credit Infrastructure That Does the Heavy Lifting

Glaas is the middleware layer between platforms and capital providers. We're the technology infrastructure that makes embedded credit possible.

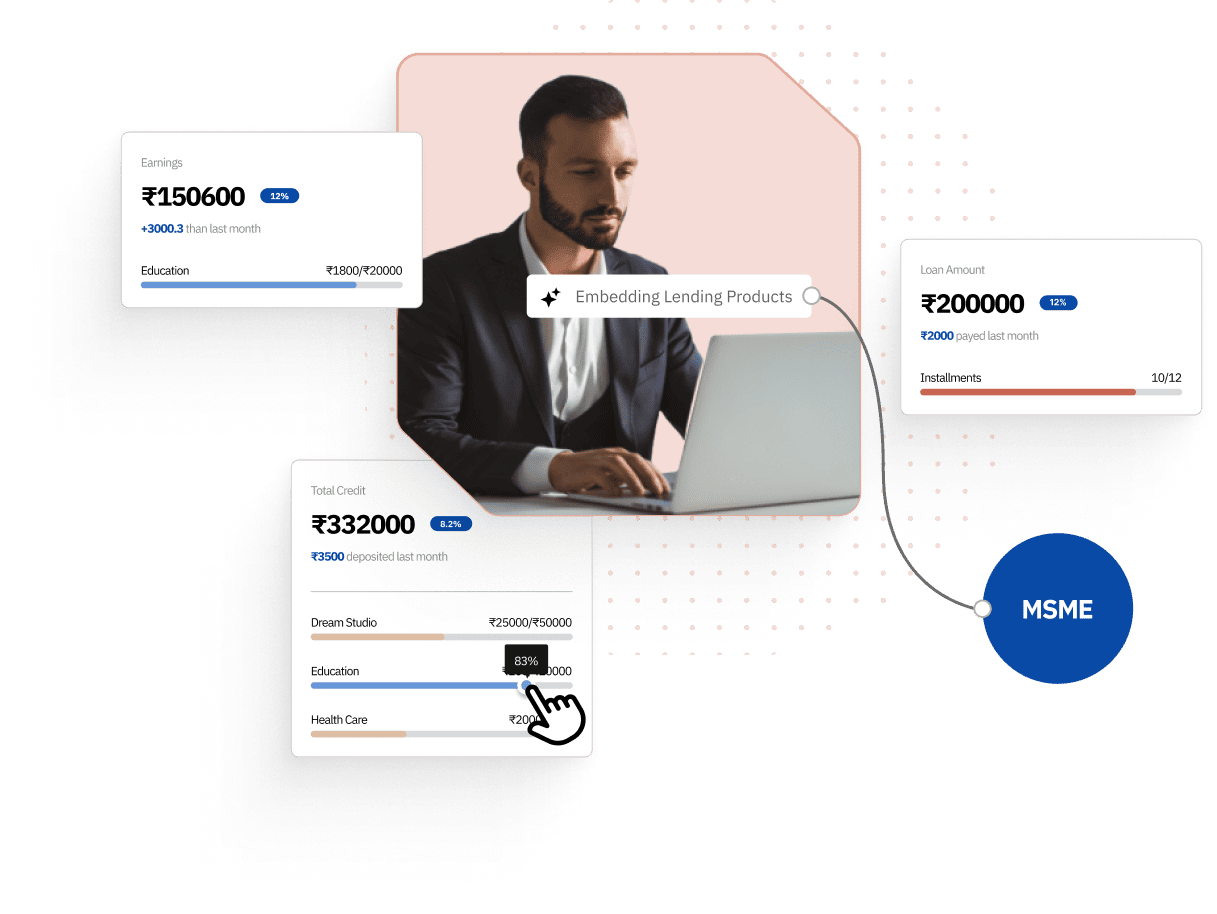

For Platforms

Think of us as Stripe for credit. Embed lending products into your platform without becoming a lender yourself. We handle underwriting, compliance, capital connections, and servicing.

For Lenders

Your co-lending operating system. Connect with high-quality sourcing partners, access rich transactional data, and automate the entire loan lifecycle from origination to collections.

For MSMEs

They get seamless credit where they already transact. No bank visits, minimal paperwork, instant approvals based on their actual business performance.

Built for Two Critical Use Cases

Digital platforms, marketplaces, SaaS companies, payment gateways

What You Get:

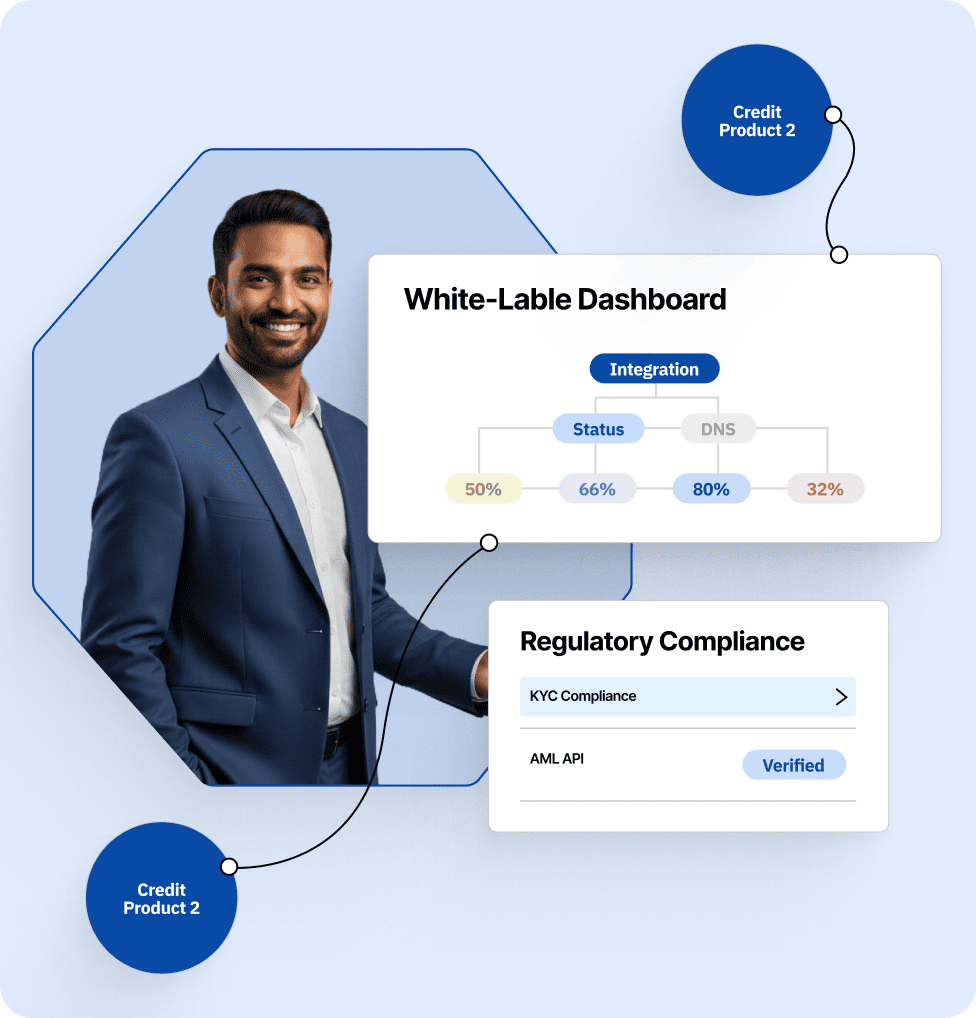

Complete infrastructure to launch credit products inside your ecosystem. White-label interfaces, automated underwriting, regulatory compliance, and access to capital—without needing an NBFC license.

Your Benefit:

New revenue stream, deeper customer relationships, reduced churn, competitive differentiation.

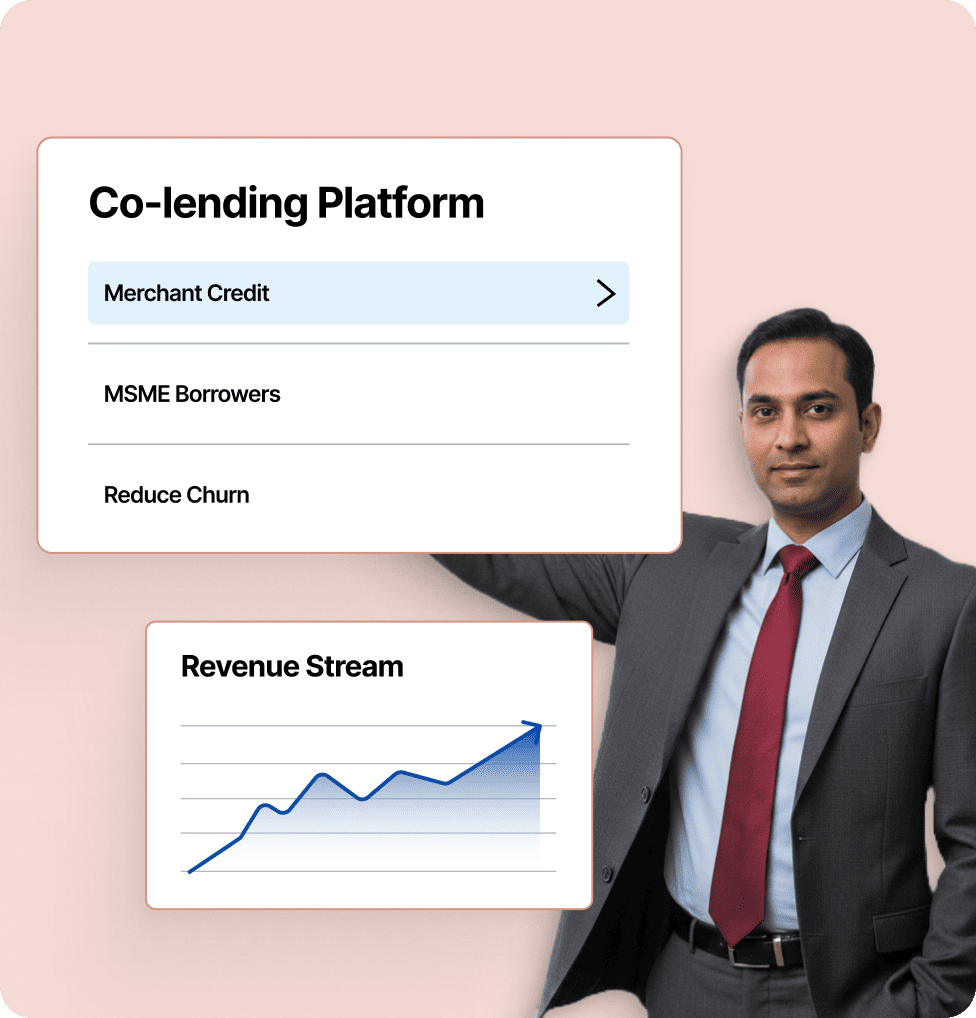

NBFCs, banks, financial institutions

What You Get:

Operating infrastructure for sourcing, underwriting, and managing co-lending partnerships. Access verified MSME borrowers from digital ecosystems with rich transactional data and FLDG protection.

Your Benefit:

Lower CAC, faster growth, better risk assessment, diversified portfolio, automated operations.

Everything You Need to Launch and Scale Credit

Glaas is the middleware layer between platforms and capital providers. We're the technology infrastructure that makes embedded credit possible.

Integration & Onboarding

- RESTful APIs with comprehensive documentation.

- White-label web and mobile SDKs.

- Sandbox environment for testing.

- Webhook support for real-time updates.

- Go live in 7-14 days.

Identity & KYC

- Multi-method verification (CKYC, DigiLocker, OKYC, VKYC).

- Automated document verification.

- Consent management framework.

- Pan-India KYC coverage.

- Fully compliant with RBI guidelines.

Data & Underwriting

- 50+ third-party data integrations (bureaus, GST, bank statements).

- Real-time transactional data from platforms.

- Configurable credit scoring models.

- Automated business rule engine.

- Custom underwriting policies.

Workflow Automation

- Visual workflow builder.

- Automated decision trees.

- Exception handling and manual intervention queues.

- Multi-level approval workflows.

- Customizable for different products.

Loan Lifecycle Management

- Application to disbursement automation.

- NACH/UPI mandate setup.

- Automated repayment collection.

- Reconciliation and settlement.

- Customer self-serve portal.

Co-Lender Connector (LAMP)

- Seamless multi-lender integration.

- Automated fund routing.

- Real-time sync with lender systems.

- Portfolio monitoring.

- Early warning systems.

Risk & Compliance

- FLDG (First Loss Default Guarantee) management.

- Portfolio concentration monitoring.

- Continuous borrower performance tracking.

- Regulatory reporting.

- Complete audit trails.

Analytics & Reporting

- Real-time dashboards.

- Custom report builder.

- Portfolio analytics.

- Cohort analysis.

- Performance metrics.

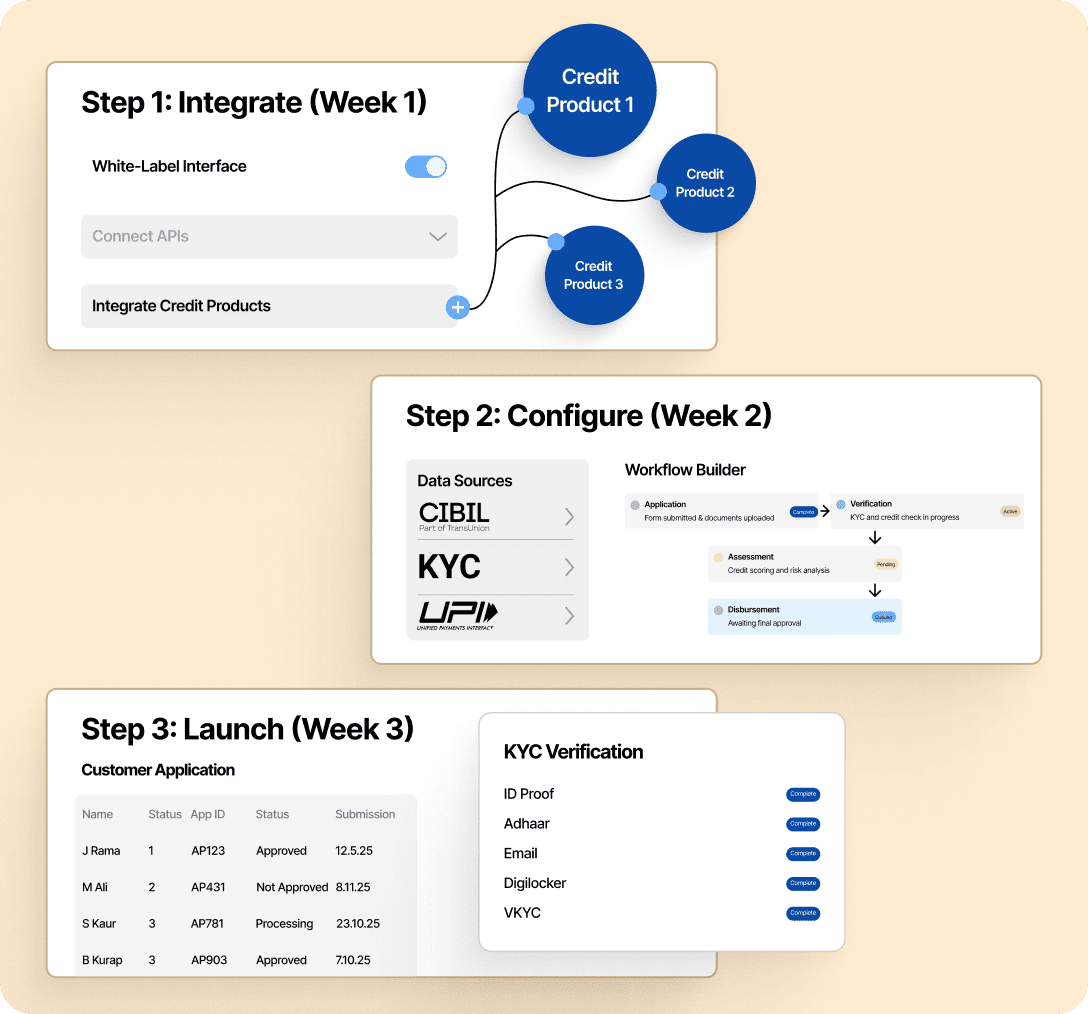

From Integration to Disbursement

in Days, Not Months

For Platforms Embedding Credit

Step 1: Integrate (Week 1)

- Connect via APIs or use white-label interface.

- Configure your credit products and terms.

- Set underwriting policies in our dashboard.

- Test in sandbox environment.

Step 2: Configure (Week 2)

- Customise workflows and approval flows.

- Set up data sources and bureau connections.

- Define your brand elements.

- Complete compliance checklist.

Step 3: Launch (Week 3 onwards)

- Go live with your first credit product.

- Your customers apply within your platform.

- Glaas handles KYC, underwriting, and decisioning.

- Funds disbursed from our lending network.

- You earn fees on every transaction.

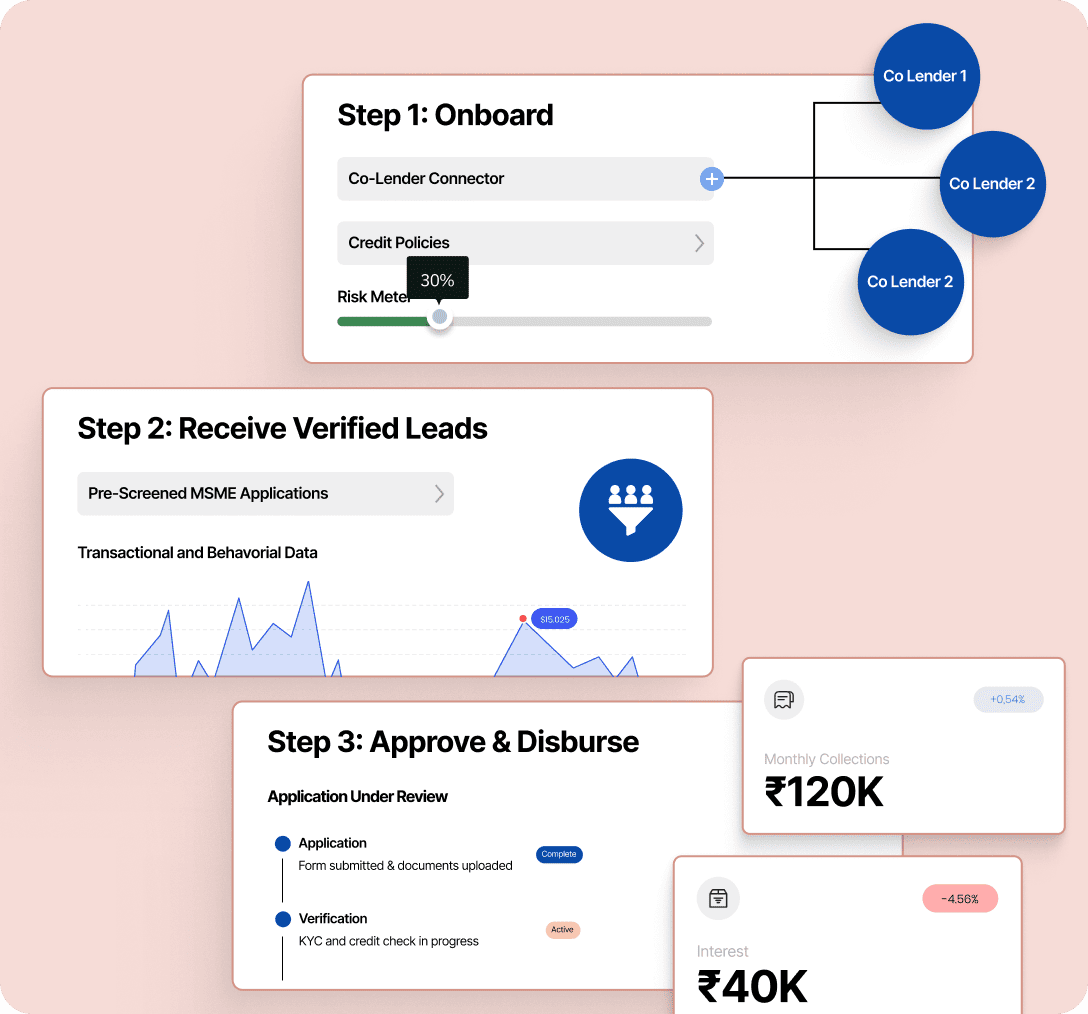

For Lenders Using Co-Lending

Step 1: Onboard

- Connect your lending systems via our co-lender connector.

- Define your risk appetite and credit policies.

- Set partnership terms and FLDG arrangements.

Step 2: Receive Verified Leads

- Get pre-screened MSME applications from sourcing partners.

- Access rich transactional and behavioural data.

- Automated underwriting based on your policies.

Step 3: Approve & Disburse

- Review and approve within your system.

- Automated disbursement and documentation.

- Ongoing monitoring and collections handled by platform.

The Most Complete Credit Infrastructure in India

Why Glaas Wins!

True Middleware Architecture

We don't compete with you. Platforms stay platform-focused. Lenders stay lender-focused. We're the neutral infrastructure layer that makes it all work.

Backed by a Regulated NBFC

Glaas is powered by Gromor Finance (registered NBFC). This means regulatory credibility, capital access, and proven lending expertise built into the platform.

Zero Capital Required (for Platforms)

Don't tie up your balance sheet. We connect you to our network of lending partners who provide the capital. You provide the distribution.

Speed to Market

What takes 6-12 months to build in-house, we deliver in 7-14 days. Pre-built infrastructure means you skip the complexity and launch fast.

Fully White-Label

Your brand, your customer experience. We're completely invisible to your end users. Glaas powers it behind the scenes.

Complete Automation

From KYC to disbursement to collections, everything runs on automated workflows. Minimal manual intervention, maximum efficiency.

Battle-Tested at Scale

Processing $150M+ in credit across 300+ partners. Our infrastructure is proven in production with real money and real customers.

Revenue Flexibility

Multiple revenue models—platform fees (0.5-1.5% of transaction value), NIM participation (4-10% annual), or custom arrangements.

Powering Credit Across Industries

Infrastructure Trusted by India's Leading Platforms

Lending Partners

Frequently asked questions:

For Platforms

For Lenders

-

Do we need an NBFC license to offer credit?

No. Glaas is backed by Gromor Finance, a registered NBFC. You leverage our license and lending partnerships to offer credit under your brand.

-

How quickly can we launch?

Most platforms go live in 7-14 days with our pre-built infrastructure. Custom implementations may take 3-4 weeks.

-

What if our customers default?

Risk is borne by the lending partners (with FLDG arrangements). You earn platform fees regardless of repayment performance.

-

Can we customise the credit products?

Absolutely. Configure loan amounts, tenures, interest rates, repayment structures, and underwriting criteria to match your business model.

-

What about customer data privacy?

We're fully compliant with data protection regulations. Customer consent is mandatory, and data is used only for credit assessment.

-

How do we earn revenue?

Multiple models—platform fees per transaction, revenue share arrangements, or NIM participation based on your preference.

-

What is co-lending and how does it work?

Co-lending allows you to partner with sourcing platforms to jointly originate loans. Typically, one lender (often Gromor) holds 20% and co-lenders hold 80%, sharing risk and returns proportionally.

-

What is FLDG?

First Loss Default Guarantee is a risk-sharing mechanism where the sourcing partner or primary lender absorbs the first X% of defaults, protecting co-lenders from initial losses.

-

How do you ensure borrower quality?

Multi-layered approach—platform transactional data, bureau checks, behavioural scoring, business validation, and automated underwriting policies that you can customise.

-

What's the typical ticket size?

Varies by industry. Generally, ₹50,000 to ₹10,00,000 for MSME loans, with individual loan caps to manage concentration risk.

-

How is my capital deployed?

Through our LAMP (Loan Asset Management Platform) system, that automates fund routing, ensures compliance, handles collections, and provides real-time portfolio monitoring.

-

What industries do you cover?

15+ industries including e-commerce, agriculture, food services, healthcare, logistics, retail, and more. Negative lists are maintained for high-risk sectors.