The Technology Layer That Turns Any Platform Into a Lender

The Embedded Credit Infrastructure for India

Complete credit infrastructure to embed financing in your ecosystem or power co-lending partnerships.

APIs, underwriting, compliance, and capital connections — all in one platform.

Powering Credit for Leading Digital Ecosystems

$150M+ Credit Processed

300+ Platforms Connected

10,000+ MSMEs Funded

15+ Industries

The Real Problem

The Credit Gap Is Costing You Growth

For Platforms & Ecosystems

- You have customers who need working capital, but no way to offer it.

- Sending leads to external lenders means losing control and revenue.

- Building in-house lending infrastructure takes years and millions in investment.

- Your merchants churn because they can't access timely credit within your ecosystem.

For MSME Lenders

- Sourcing quality MSME borrowers is expensive and time-intensive.

- You lack access to real-time transactional data for better underwriting.

- Traditional branch-based lending models can't scale to digital-first businesses.

- Co-lending partnerships are complex to structure, execute, and manage.

You need infrastructure that handles the complexity—so you can focus on your customers.

Credit Infrastructure That Does the Heavy Lifting

Glaas is the middleware layer between platforms and capital providers. We're the technology infrastructure that makes embedded credit possible.

For Platforms

Think of us as Stripe for credit. Embed lending products into your platform without becoming a lender yourself. We handle underwriting, compliance, capital connections, and servicing.

For Lenders

Your co-lending operating system. Connect with high-quality sourcing partners, access rich transactional data, and automate the entire loan lifecycle from origination to collections.

For MSMEs

They get seamless credit where they already transact. No bank visits, minimal paperwork, instant approvals based on their actual business performance.

Built for Two Critical Use Cases

Digital platforms, marketplaces, SaaS companies, payment gateways

What You Get:

Complete infrastructure to launch credit products inside your ecosystem. White-label interfaces, automated underwriting, regulatory compliance, and access to capital—without needing an NBFC license.

Your Benefit:

New revenue stream, deeper customer relationships, reduced churn, competitive differentiation.

NBFCs, banks, financial institutions

What You Get:

Operating infrastructure for sourcing, underwriting, and managing co-lending partnerships. Access verified MSME borrowers from digital ecosystems with rich transactional data and FLDG protection.

Your Benefit:

Lower CAC, faster growth, better risk assessment, diversified portfolio, automated operations.

Everything You Need to Launch and Scale Credit

Glaas is the middleware layer between platforms and capital providers. We're the technology infrastructure that makes embedded credit possible.

Integration & Onboarding

- RESTful APIs with comprehensive documentation.

- White-label web and mobile SDKs.

- Sandbox environment for testing.

- Webhook support for real-time updates.

- Go live in 7-14 days.

Identity & KYC

- Multi-method verification (CKYC, DigiLocker, OKYC, VKYC).

- Automated document verification.

- Consent management framework.

- Pan-India KYC coverage.

- Fully compliant with RBI guidelines.

Data & Underwriting

- 50+ third-party data integrations (bureaus, GST, bank statements).

- Real-time transactional data from platforms.

- Configurable credit scoring models.

- Automated business rule engine.

- Custom underwriting policies.

Workflow Automation

- Visual workflow builder.

- Automated decision trees.

- Exception handling and manual intervention queues.

- Multi-level approval workflows.

- Customizable for different products.

Loan Lifecycle Management

- Application to disbursement automation.

- NACH/UPI mandate setup.

- Automated repayment collection.

- Reconciliation and settlement.

- Customer self-serve portal.

Co-Lender Connector (LAMP)

- Seamless multi-lender integration.

- Automated fund routing.

- Real-time sync with lender systems.

- Portfolio monitoring.

- Early warning systems.

Risk & Compliance

- FLDG (First Loss Default Guarantee) management.

- Portfolio concentration monitoring.

- Continuous borrower performance tracking.

- Regulatory reporting.

- Complete audit trails.

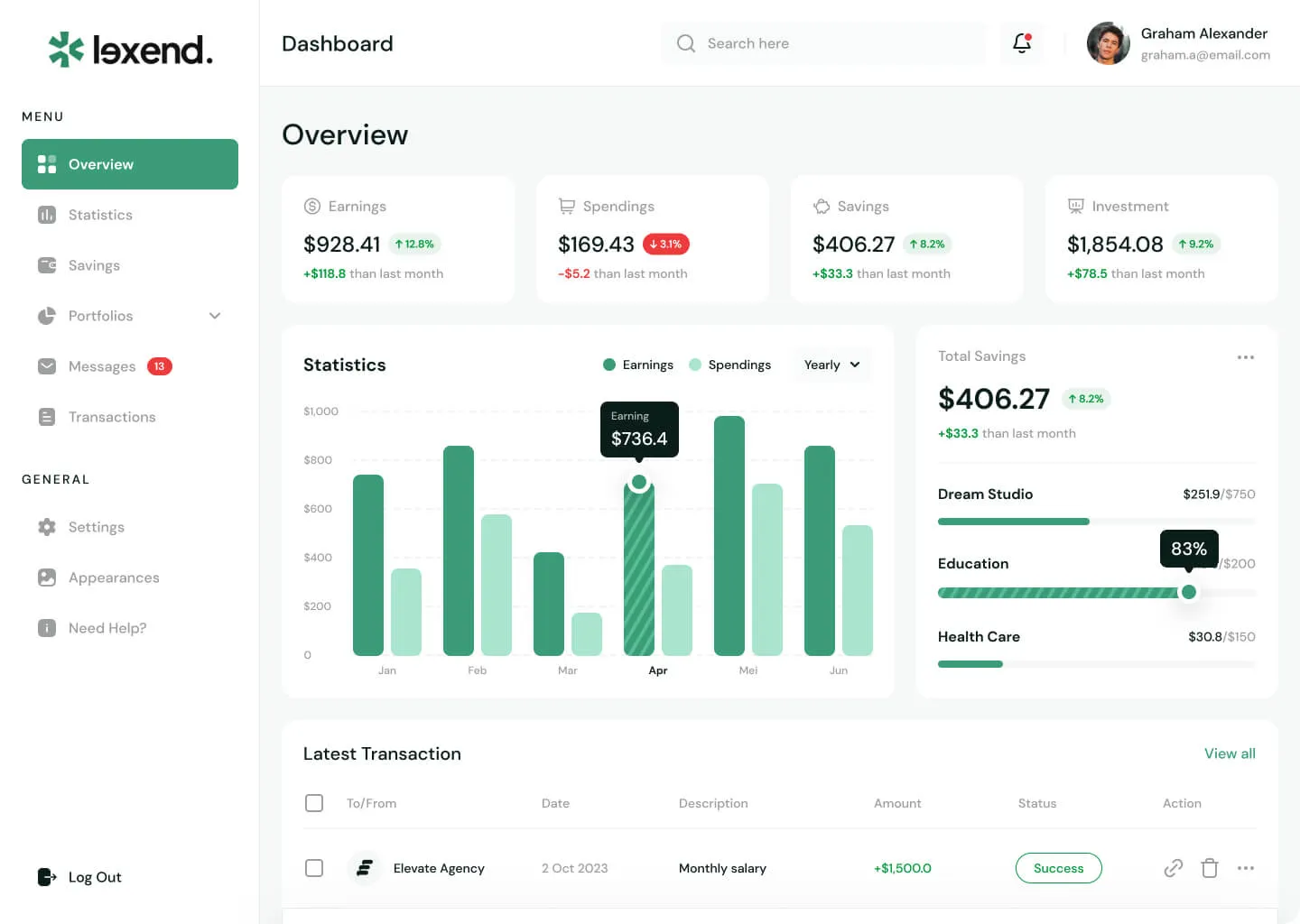

Analytics & Reporting

- Real-time dashboards.

- Custom report builder.

- Portfolio analytics.

- Cohort analysis.

- Performance metrics.

Share tools quickly and confidently in minutes

This powerfull tool eliminates the need to leave Salesforce to get things done as I can create a custom proposal with dynamic pricing tables. You can also customize your own dynamic Software versions.

“Most of our time used to be taken up by administrative work whereas now we can focus on building out programs to help our employees.”

Mark Zellers

Director of Human Resources.

Connect every part of your entire business

Keep data consistent, with native CRM integrations that streamline your entire Tool workflow.

“I can create a custom proposal with dynamic pricing tables, and get approval from my boss all within 36 minutes.”

Matt Henderson

Client Success Manager

Maintain compliance and control your apps

Improve security and trust with built-in legally binding e-Signatures. Create pre-approved templates, content blocks and lock all legal information to prevent costly mistakes.

“This powerful tool eliminates the need to leave Salesforce to get things done.”

Natalia Larsson

Director of Sales Operations

Review quickly and confidently

Get real-time access to approvals, comments and version tracking. Smart features like variables and conditional logic help you eliminate Tool errors.

“We are based in Europe and the latest Data Protection Regulation forces us to look for service suppliers than comply with this regulation.”

Sarah Edrissi

Lead Marketing

Simple, scalable pricing.

No extra charges. No hidden fees.

Essentials

For creating impressive tools that generate results.

Business

For seamless integrations and sending tools in bulk.

Enterprise

For large companies with complex Tool workflows.

Prices exclude any applicable taxes.

What clients said:

“Most of our time used to be taken up by administrative work whereas now we can focus on building out programs to help our employees.

Lorem ipsum dolor sit amet consectetur adipisicing elit. Quas nisi consectetur adipisci eaque. Porro, atque.”

Mark Zellers

Director of Human Resources.

“I can create a custom proposal with dynamic pricing tables, and get approval from my boss all within 36 minutes and looks fantastic.

Dolor sit amet consectetur adipisicing elit. Quas nisi consectetur adipisci eaque. Porro, atque.”

André Garcia

Client Success Manager

“This powerfull tool eliminates the need to leave Salesforce to get things done,

quas libero placeat voluptates sed sequi? Corporis, earum vitae.

Tempore pariatur dignissimos coming for great tool of repellat quae a eaque culpa iusto fugit.”

Matt Henderson

Director of Sales OperationsTrusted by well-known brands.

Gain valuable insights

The unrealized potential of olfactory design

- •

-

July 13, 2024

Native apps with unknown JavaScript APIs

- •

-

July 13, 2024

Stop worrying and love multimedia writing

- •

-

July 13, 2024

Create stunning websites that fits your needs.

Have what it takes to be one of us.

14-day trial, no credit card required.